13 Jackpot How To Apply For Erc Free

13 Professional How To Apply For Erc - If you received a ppp loan, you may still qualify for the erc for. It is claimed on form 941, employer’s quarterly federal tax return.

What Documentation Do I Need to Apply for the ERC? Revenued . It does not constitute accounting advice and should not be construed as such.

What Documentation Do I Need to Apply for the ERC? Revenued . It does not constitute accounting advice and should not be construed as such.

How to apply for erc

8 Value How To Apply For Erc. To claim the erc, you must file a federal form 941 for the applicable quarter. This guide will cover what this tax credit entails, how to apply for the erc, and common challenges businesses face when trying to claim it. For accounting assistance with your ertc application you should fill in the apply for erc relief form on our home page to receive your free erc eligibility assessment. How to apply for erc

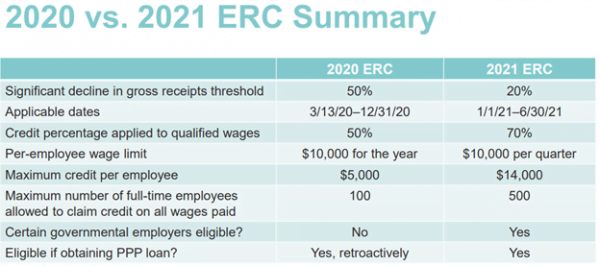

Although the limit on the maximum erc in the first half of 2021 of 70% of up to $10,000 of an employee’s qualified wages per calendar quarter (i.e., $7,000) continues to apply to the third and fourth calendar quarters of 2021, the For those who utilized the erc, it is important to understand the proper accounting surrounding the credit. Since the 2020 941 or 944 payroll forms should have already been filed, the applicable reports would need to be amended to claim the credits. How to apply for erc

Ppp applications and forgiveness, as applicable. This is a quick and simple video explaining which researchers are eligible to apply for european research council grants, at what points in their career, wha. Calculate your potential erc amount using our tax credit estimator. How to apply for erc

This article is for informational purposes only. In order to capitalize on the employee retention credit (erc) as a new business, you need to find an accountant to help you make the calculations. In order to qualify for the erc you must have paid your employees “qualified wages” during 2020 or 2021. How to apply for erc

How to apply for employee retention credit. At that time, the erc applied to wages paid after march 12, 2020 and before january 1, 2021. It was created to encourage small businesses to keep people employed during covid. How to apply for erc

How to account for the employee retention credit. The employee retention credit (erc) is a refundable credit that was created by the covid aid relief, and economic security (cares) act. Wages paid after march 12, 2020, but before january 1, 2021, are eligible for the credit. How to apply for erc

What forms do i need to apply for the employee retention credit (erc)? Employers should consult with appropriate legal and tax advisors to determine whether the organization is eligible for the erc, noting the different rules that apply for 2020 and 2021. It’s important to understand the difference between claiming the credit and applying for the erc advance. How to apply for erc

Then with the american rescue On december 27, 2020, the taxpayer certainty and disaster tax relief act (part of the consolidated appropriations act of 2021) was signed into law, providing further stimulus and. To apply for the advance payment of the erc, the employer needs to file federal form 7200. How to apply for erc

Applying for an employer registration certificate (erc) the This means an employer could claim up to $7,000 per quarter per employee, or $21,000 per employee for 2021. Check part 2, box 5d. How to apply for erc

The employee retention credit for 2020 is equal to half of qualified employee pay earned in a calendar quarter. Receive a credit of up to 50% of each employee’s qualified wages, up to $5,000 for the year. Check part 1, box 2. How to apply for erc

Complete the company information on each page, the “return you’re correcting” information in the upper right corner and enter the date you discovered the errors. The calculations become even more involved when care is taken to maximizing the amount of erc you get while ensuring that no double dipping has occurred. Here at the fitness cpa, we are providing free calculations for all. How to apply for erc

There is no fee to apply. Do you qualify for ppp round 2 with the paycheck protection program’s round two under way and many company’s forgiveness applications for round one accepted, business owners are wondering if they qualify. Here is how to apply for the erc in five easy steps. How to apply for erc

These changes apply to the period from march 13, 2020, to dec. Consider group health plan expenses as qualified wages, even if no other wages are paid to an employee. If the employer is an annual filer, they can claim it on form 944. How to apply for erc

An overview of the employee retention credit the u.s. Employers must apply to labour standards for an employer registration certificate to recruit and hire foreign workers in nova scotia. However, congress later modified and extended the erc to apply to wages paid before july 1, 2021. How to apply for erc

The total amount of the erc is represented as a negative amount. The erc is not an income tax credit, but a payroll tax credit. This page is not current find current guidance on the employee retention credit for qualified wages paid during these dates: How to apply for erc

ERC Credit for 1099 COS ACCOUNTING & TAX . This page is not current find current guidance on the employee retention credit for qualified wages paid during these dates:

ERC Credit for 1099 COS ACCOUNTING & TAX . This page is not current find current guidance on the employee retention credit for qualified wages paid during these dates:

Twelve tips on how to prepare an ERC grant proposal . The erc is not an income tax credit, but a payroll tax credit.

Twelve tips on how to prepare an ERC grant proposal . The erc is not an income tax credit, but a payroll tax credit.

ERC Tax Credit COS ACCOUNTING & TAX . The total amount of the erc is represented as a negative amount.

ERC Tax Credit COS ACCOUNTING & TAX . The total amount of the erc is represented as a negative amount.

Employee Retention Credits How can they help your . However, congress later modified and extended the erc to apply to wages paid before july 1, 2021.

Employee Retention Credits How can they help your . However, congress later modified and extended the erc to apply to wages paid before july 1, 2021.

PPP Do Not Apply Until You Have an Employee . Employers must apply to labour standards for an employer registration certificate to recruit and hire foreign workers in nova scotia.

PPP Do Not Apply Until You Have an Employee . Employers must apply to labour standards for an employer registration certificate to recruit and hire foreign workers in nova scotia.

Full erc 2010_guidelines . An overview of the employee retention credit the u.s.

Full erc 2010_guidelines . An overview of the employee retention credit the u.s.