7 Convert Income Tax How To Pay Latest

9 Expert Income Tax How To Pay - How to make a payment to the ato. To make payment at an dbs atm, you need the payment slip that is issued with your tax bill.

Why We Pay Taxes HISTORY . (102) surtax this option is rarely used at the time of making the tax payment.

Why We Pay Taxes HISTORY . (102) surtax this option is rarely used at the time of making the tax payment.

Income tax how to pay

9 Hoak Income Tax How To Pay. Pay your tax bill pay self assessment now you can make weekly or monthly payments towards your bill, if you prefer. If you are filing your itr and your tax is payable than you can pay yourself online without visiting any place. First of all you need an internet banking account with the fpx participating bank. Income tax how to pay

Income tax refers to a percentage of your income that you are liable to pay directly to the government. The easiest way to pay is with bpay or a credit or debit card. (106) tax on it is Income tax how to pay

Your household income, location, filing status and number of personal exemptions. Your bracket depends on your taxable income and filing status. An education cess of 3% of tax plus surcharge is also charged from such entities. Income tax how to pay

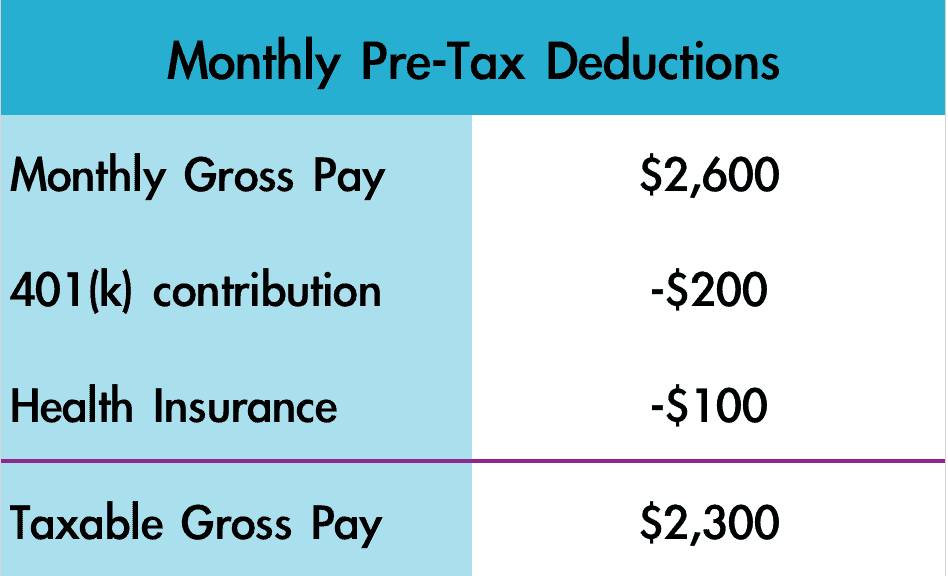

Who has to pay income tax in malaysia? Your ctc is your gross pay. A surcharge of 7% is levied on domestic companies if their total income exceeds ₹ 1 crore. Income tax how to pay

You may also have to pay state income taxes, depending on. Don't miss to pay income tax if tax is payabl. Pay income tax iras via dbs atm. Income tax how to pay

Your ctc comprises basic pay, variable pay, allowances, and perquisites. Types of individual income individual income includes salary and wages, foreign superannuation and other overseas income, voluntary work and individualised funding. However, salaried employees are not mandatorily required to pay advance tax on salary income, as their tds is already deducted. Income tax how to pay

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: 10%, 12%, 22%, 24%, 32%, 35% and 37%. How income taxes are calculated. Income tax how to pay

Enter the 14 digits payment slip number as the bill reference number. Insert card in card slot. See what you owe and pay by bank account. Income tax how to pay

The money collected by this direct tax route is used by the government for infrastructural developments and also to pay the employees of central and state government bodies. Most of us pay advance tax on our income, ensuring that the overall tax liability is split up into portions, thereby reducing burden on us to pay a lump sum in one go. One of the easiest ways to save tax is to exclude maintenance charges from the rent received. Income tax how to pay

Tax codes and tax rates for individuals how tax rates and tax codes work. Out of the gross profit, exemptions and deductions are deducted. 1) pay income tax via fpx services the fpx (financial process exchange) gateway allows you to pay your income tax online in malaysia. Income tax how to pay

A look at our salary slips shows the amount deducted every month as tax , with this computation being done at an approximate level, but the actual tax liability can differ from the amount which has been. Some people include maintenance charges in the rent, which increases the whole rent amount; A tax of flat 30% is computed on the total income. Income tax how to pay

Use our tax code finder and tax on annual income calculator. In a way, it grows tax on the rent income. Log in to view the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Income tax how to pay

You can get help if you cannot pay your tax bill on time. Phone the government easypay service on 1300 898 089. For those earning rm25,501 (after epf deductions) each year, a tax file must be registered. Income tax how to pay

A surcharge of 12% is levied on domestic companies if their total income exceeds ₹ 10 crore. There are seven federal tax brackets for the 2021 tax year: With effect from 2010 those earning rm26,501 (after epf. Income tax how to pay

Note that your personal allowance decreases by £1 for every £2 you earn over £100,000. Between £50,271 and £150,000, you'll pay at 40% (known as the higher rate) and above £150,000, you'll pay 45% (the additional rate). In most cases, your employer will deduct the income tax from your wages and pay it to the ato. Income tax how to pay

Yes, income tax is calculated on ctc. We also have other payment options available. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Income tax how to pay

Income tax act of india, passed in 1961, governs the provisions for. Income tax how to pay

How to Pay Advance Tax Through Online SBI YouTube . Income tax act of india, passed in 1961, governs the provisions for.

How to Pay Advance Tax Through Online SBI YouTube . Income tax act of india, passed in 1961, governs the provisions for.

How to Pay Tax Online That Is Due BankBazaar . Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

How to Pay Tax Online That Is Due BankBazaar . Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

How To Pay Tax Online In India? FINANCE guru . We also have other payment options available.

How To Pay Tax Online In India? FINANCE guru . We also have other payment options available.

Step by step guide on how to pay Tax that is due . Yes, income tax is calculated on ctc.

Step by step guide on how to pay Tax that is due . Yes, income tax is calculated on ctc.

Have tax due? Here’s how to pay it Top Business . In most cases, your employer will deduct the income tax from your wages and pay it to the ato.

Have tax due? Here’s how to pay it Top Business . In most cases, your employer will deduct the income tax from your wages and pay it to the ato.

Gross Pay vs Net Pay How to Budget Your The Right Way . Between £50,271 and £150,000, you'll pay at 40% (known as the higher rate) and above £150,000, you'll pay 45% (the additional rate).

Gross Pay vs Net Pay How to Budget Your The Right Way . Between £50,271 and £150,000, you'll pay at 40% (known as the higher rate) and above £150,000, you'll pay 45% (the additional rate).