10 Effective How To Write Credit Dispute Letters Full

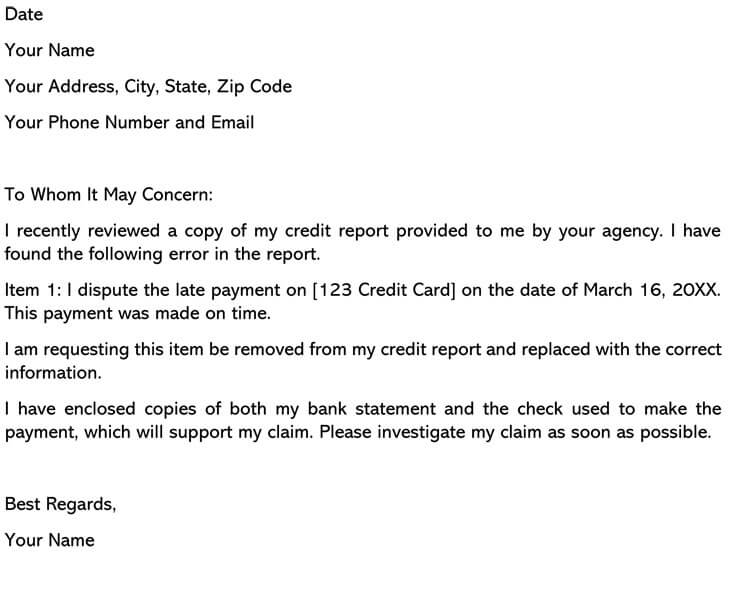

7 Studies How To Write Credit Dispute Letters - These sample letters are meant to give you ideas on how to structure your own credit dispute letters. Late payment letter to credit bureaus, round 1.

10+ Sample Dispute Letter To Creditor Cecilprax . This letter requests that the credit bureau verify the late payment with the creditor.

How to write credit dispute letters

10 Basic How To Write Credit Dispute Letters. Writing a dispute letter to a creditor is not complicated but requires some attention. You must make copies in your data, and also you must also preserve copies of any correspondences or letters despatched to you from the opposite. How to write a credit dispute letter august 24, 2021 / tayne law group / debt help, debt relief, diy, personal finance, your credit / 0 comments according to a recent investigation by consumer reports, a third of americans have errors on their credit reports. How to write credit dispute letters

In the top left corner of the letter, write your contact information first by including your legal name, address, telephone number, and, if you desire, your email address. Download our sample letter and instructions to submit a dispute. Collector’s name collector’s address city, state, zip code. How to write credit dispute letters

If you’ve noticed something awry in your credit report, there’s a lot you can do to take action and fix the problem. Always attach supporting documents such as bills or legal papers that prove the credit errors and get them removed. You may want to enclose a copy of your credit report with the items in question circled. How to write credit dispute letters

Write them neatly, with a polite but firm tone. How to write a credit dispute letter if you already have proof that an item is an error—or you do once you receive information related to a 609 letter—it’s time to write a dispute letter. Next, include your social security number directly underneath as that is usually the primary way the credit bureaus identify your dispute case. How to write credit dispute letters

Posted by january 31, 2022 minnesota valley photo club on how to write a dispute letter to credit bureaus In fact, credit score dispute letters ought to all the time be in writing, and signed. Write a credit dispute letter to the credit bureaus to successfully remove one or more negative items from your credit report. How to write credit dispute letters

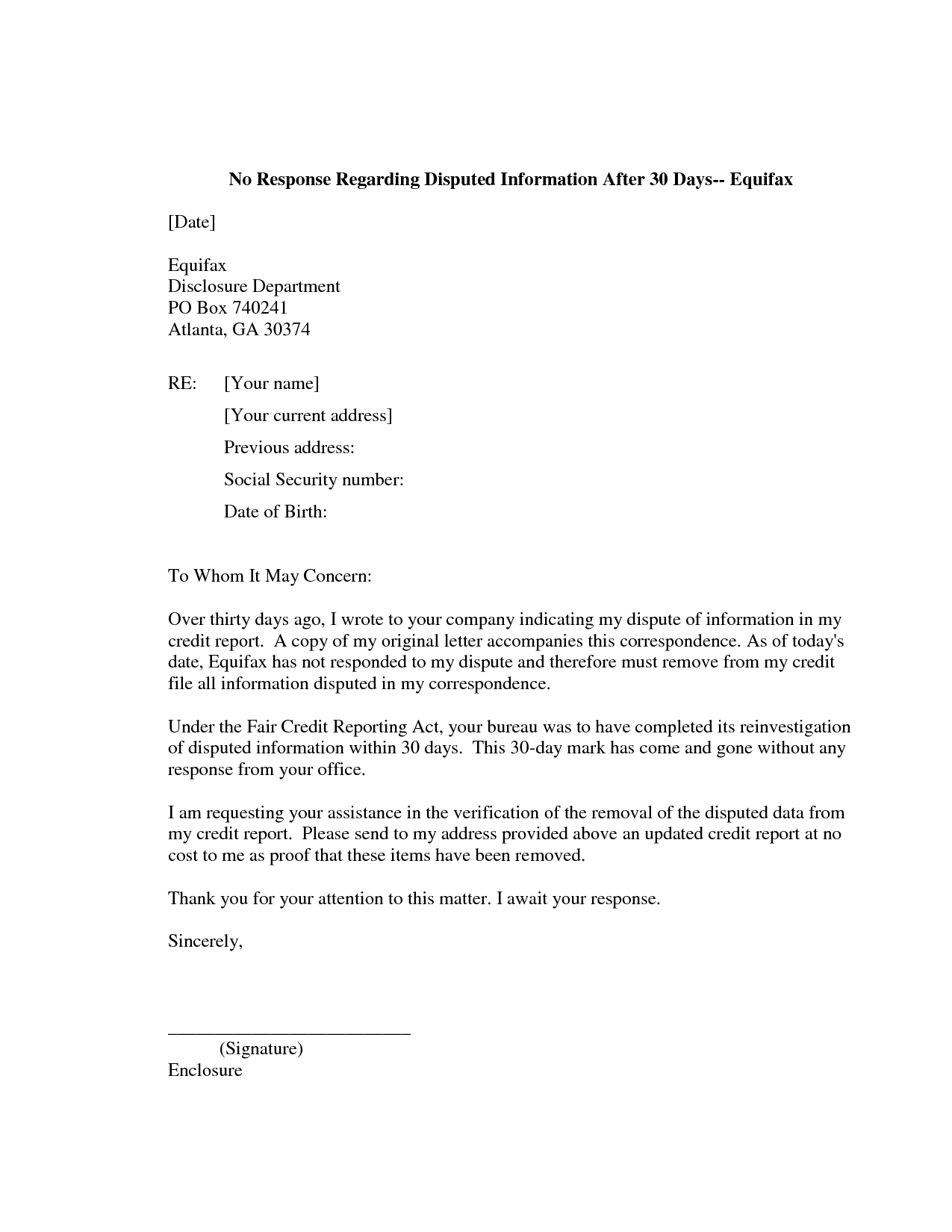

Usually, the term credit dispute letter refers to letters sent to correct errors on a credit report. The major credit bureaus currently allow consumers to send disputes online, so you can simply follow their online instructions. Replace the credit bureau’s name How to write credit dispute letters

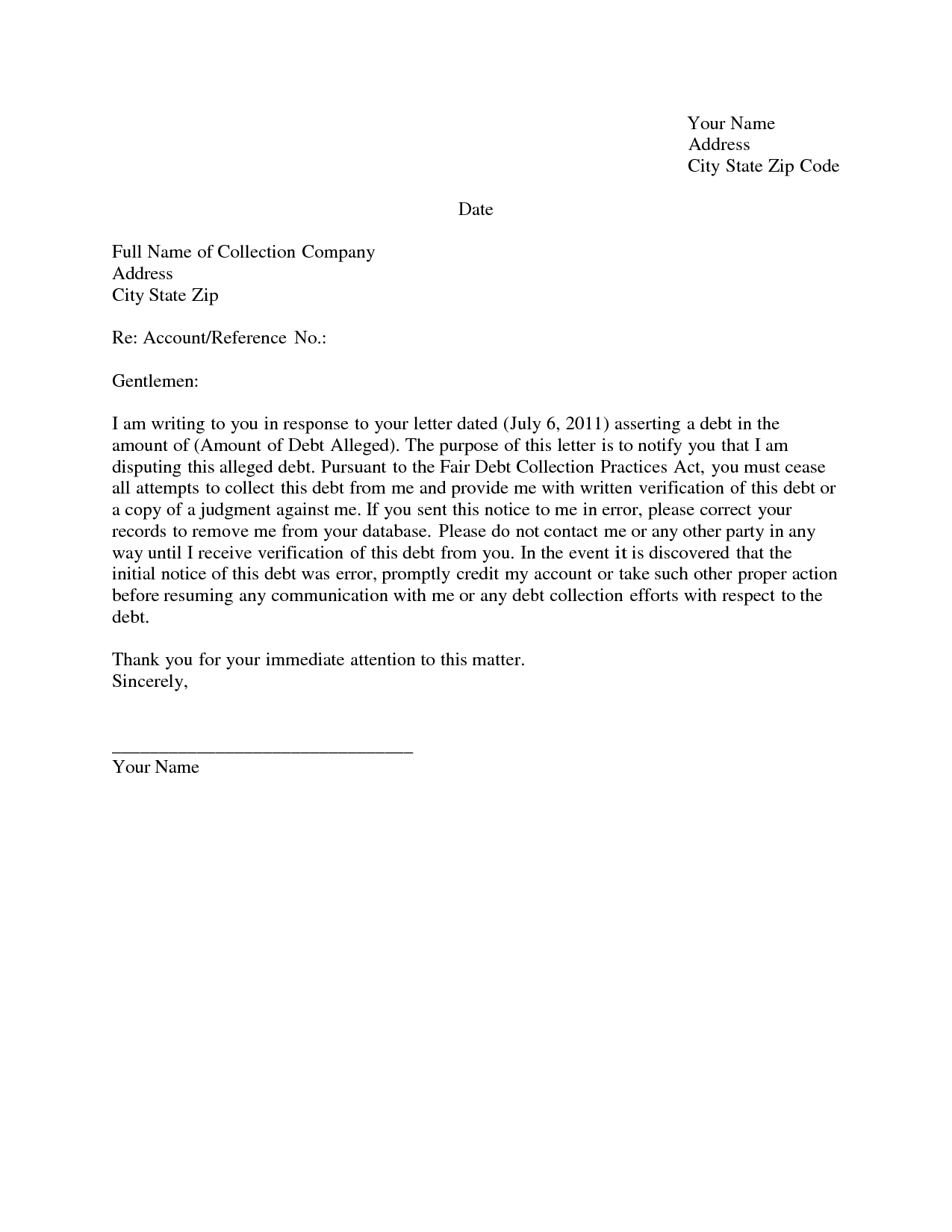

Pursuant to the fair debt collection practices act, section 809(b), validating debts: Letters can also help you dispute credit report issues such as collections notices and late payments. How to write a credit report dispute letter? How to write credit dispute letters

How to write a dispute letter to credit bureaus nightmare before christmas shock costume by martin detry the technique is certainly not new. How to dispute collections letter. Determine what you need to dispute. How to write credit dispute letters

Use this sample letter to dispute mistakes on your credit report. How to write a dispute letter to credit bureaus Get your copy of your credit. How to write credit dispute letters

Sample dispute letter to a collection agency. A credit dispute letter is a written document sent from a borrower to their lender or to a credit bureau/agency. Sample letters to dispute information on a credit report. How to write credit dispute letters

Credit report dispute this guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or incomplete, and you would like to submit a dispute of that information to the. Keep the credit report dispute letter to one page in length, keep it concise and focus on providing the information the credit bureau needs to identify you and the issue you are raising. As such, these credit dispute letters should be treated as though they will become evidence in your lawsuit. How to write credit dispute letters

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. The above letter works for all three credit bureaus. How to write credit dispute letters

If you do not attach supporting documents, the creditors will stick to the entry to be negative and then do nothing about it. Example letters for debt settlement, validation & credit from nomorecreditcards.com how do i dispute the debt? Send this letter to credit bureaus if any account is reporting a late payment. How to write credit dispute letters

How to write a credit card dispute letter for charges over 90 days with a sample 1. How to write credit dispute letters

609 Dispute Letter to Credit Bureau Template Examples . How to write a credit card dispute letter for charges over 90 days with a sample 1.

609 Dispute Letter to Credit Bureau Template Examples . How to write a credit card dispute letter for charges over 90 days with a sample 1.

Sampe Credit Report Dispute Letters (How to Write) Word PDF . Send this letter to credit bureaus if any account is reporting a late payment.

Sampe Credit Report Dispute Letters (How to Write) Word PDF . Send this letter to credit bureaus if any account is reporting a late payment.

FREE 34+ Sample Formal Letter Formats in PDF MS Word . Example letters for debt settlement, validation & credit from nomorecreditcards.com how do i dispute the debt?

FREE 34+ Sample Formal Letter Formats in PDF MS Word . Example letters for debt settlement, validation & credit from nomorecreditcards.com how do i dispute the debt?

View Credit Report Dispute Letter Pdf Cecilprax . If you do not attach supporting documents, the creditors will stick to the entry to be negative and then do nothing about it.

View Credit Report Dispute Letter Pdf Cecilprax . If you do not attach supporting documents, the creditors will stick to the entry to be negative and then do nothing about it.

Credit Dispute Letter To Collection Agency planner . The above letter works for all three credit bureaus.

Credit Dispute Letter To Collection Agency planner . The above letter works for all three credit bureaus.

Credit Dispute Letter Template Luxury How to Write A Free . If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company.

Credit Dispute Letter Template Luxury How to Write A Free . If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company.