9 Succeed How To Calculate The Company Value Full

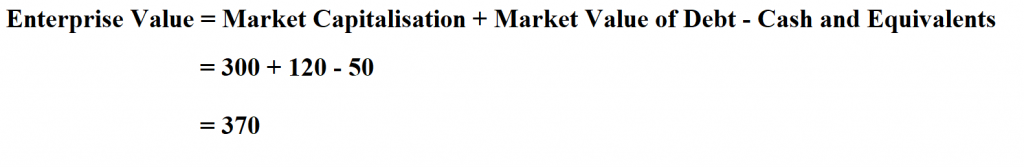

5 Latest How To Calculate The Company Value - The company's owner is hoping to sell the business to pursue other avenues of employment, so they calculate the company's enterprise value for a general idea of how much it's worth: If the shares only trade over the counter, then the trading volume may be so.

Calculating MarketValueBased Capital Structure YouTube . By using financial information from peer groups, we can estimate the valuation of a target firm.

Calculating MarketValueBased Capital Structure YouTube . By using financial information from peer groups, we can estimate the valuation of a target firm.

How to calculate the company value

8 Absolutely How To Calculate The Company Value. Calculate the intrinsic value of your company: How to calculate business value calculating business value is based on a number of factors. Decide the level of valuation. How to calculate the company value

There are a few methods to calculate the valuation of a private company. Intrinsic value measures the value of a stock based on its company's cash flows. What is the value of my business? How to calculate the company value

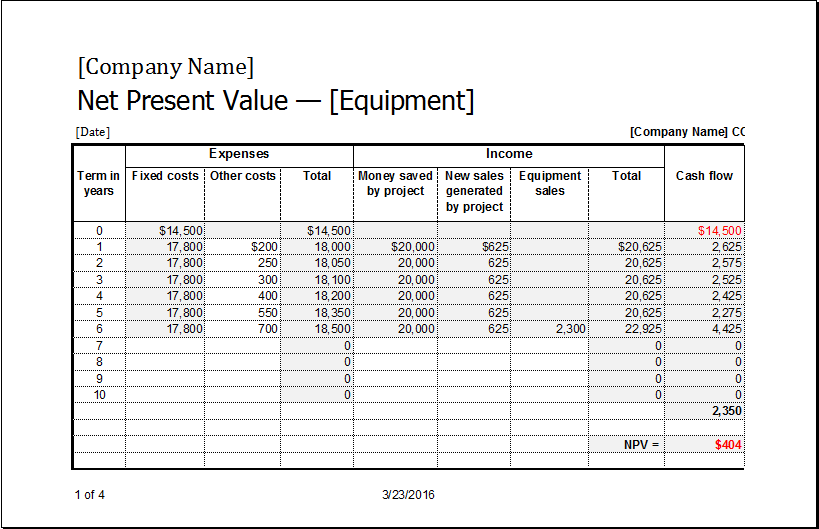

For small businesses, the range is often between 0 and 3. Net present value (npv) net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Consider the inventory, property, machinery, real. How to calculate the company value

And, like most complex mathematical problems, understanding your company’s value depends on a variety of factors, like vertical market and industry performance, proprietary. Here are the three steps leung follows to determine the value of a company. To calculate the intrinsic value of a company warren buffett's style, we can use a present value growth annuity formula. How to calculate the company value

Intrinsic value calculation based on p/e ratio. Similar to bond or real estate valuations, the value of a business can be expressed as the present value of expected future earnings. If you are interested in a company in any way, you must use the total value formulas available to determine what it's worth. How to calculate the company value

A valuator can prepare three different levels of report ranging from basic to highly detailed. V 0 = b v 0 + ∑ r i t ( 1 + r ) t where: The first step is to determine the level of complexity and assurance needed in the valuation report. How to calculate the company value

Understanding your company’s value becomes increasingly important as the business grows, especially if you want to raise capital, sell a portion of the business, or borrow money. Estimate all of a company’s future cash flows; To calculate the intrinsic value of a company warren buffett's style, we can use a present value growth annuity formula. How to calculate the company value

It is calculated by considering the market value of a company divided by the total number of outstanding shares. The market/book ratio is used to compare a company’s market value to its book value. B v 0 = current How to calculate the company value

Only then will you know whether it's worth spending money on. The number of shares outstanding is listed in the equity section of a company's balance sheet. However, you may want a more detailed analysis of what your business is worth, instead of just a thumb in the air estimate. How to calculate the company value

Building an intrinsic value calculator with python. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners, level of risk, and possible adjustments. To calculate this market value, multiply the current market price of a company's stock by the total number of shares outstanding. How to calculate the company value

The 2 nd part is to divide the shareholders’ common equity, which is available to the equity shareholders by the outstanding number of common equity shares. You can use formulas for the book value, liquidation value, market value or enterprise value. You can get a general idea of how much a company is worth by looking at: How to calculate the company value

Valuation of a company by stock price. Fvj = net cash flow for the j. Discover why pitchbook is the only tool you need for your next private company valuation. How to calculate the company value

Also, for an indispensable person who is of utmost importance to the business, also has a replacement cost which is needed in order to calculate the fair value of all the “assets” of the company. It is calculated by dividing the market value per share by the book value per share. If you have discretionary earnings of $100,000 and you believe that you deserve a multiple of 1.5, your intangible assets have an estimated value of. How to calculate the company value

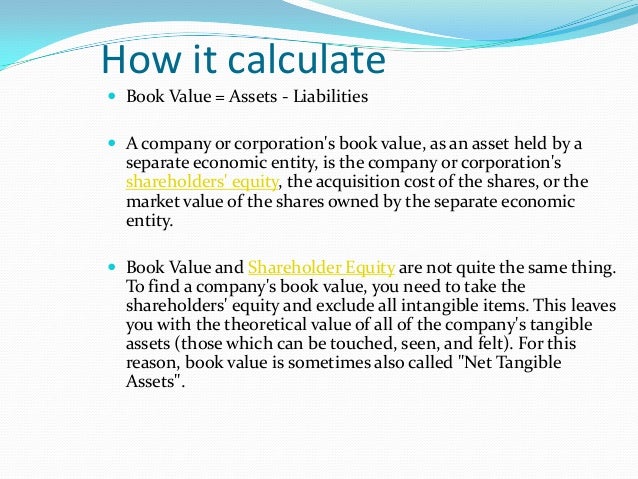

Formula to calculate book value of a company book value formula calculates the net asset of the company derived by total of assets minus the total liabilities. Company assets getting a ballpark value by using the business valuation calculator above will be useful to buyers, sellers, brokers, and other parties who need a quick estimate. How to calculate the company value

What is Enterprise Value . Company assets getting a ballpark value by using the business valuation calculator above will be useful to buyers, sellers, brokers, and other parties who need a quick estimate.

What is Enterprise Value . Company assets getting a ballpark value by using the business valuation calculator above will be useful to buyers, sellers, brokers, and other parties who need a quick estimate.

Basic valuation concept final . Formula to calculate book value of a company book value formula calculates the net asset of the company derived by total of assets minus the total liabilities.

Basic valuation concept final . Formula to calculate book value of a company book value formula calculates the net asset of the company derived by total of assets minus the total liabilities.

Book value per share of common stock explanation . If you have discretionary earnings of $100,000 and you believe that you deserve a multiple of 1.5, your intangible assets have an estimated value of.

Lower of Cost and Net Realizable Value (LCNRV) Open . It is calculated by dividing the market value per share by the book value per share.

How to Calculate Enterprise Value. . Also, for an indispensable person who is of utmost importance to the business, also has a replacement cost which is needed in order to calculate the fair value of all the “assets” of the company.

How to Calculate Enterprise Value. . Also, for an indispensable person who is of utmost importance to the business, also has a replacement cost which is needed in order to calculate the fair value of all the “assets” of the company.

How To Calculate Company Value From Stock Stocks Walls . Discover why pitchbook is the only tool you need for your next private company valuation.

How To Calculate Company Value From Stock Stocks Walls . Discover why pitchbook is the only tool you need for your next private company valuation.