13 Value How To Get Previous Years Tax Returns Free

10 Compulsive How To Get Previous Years Tax Returns - Tax time is extra stressful when you've skipped a few years. I have submitted my tax return for this year but have been told they won't pay out until i submit my outstanding tax returns from last year (fair enough).

HMRC penalty notices to be sent out for failure to submit . 1994 general income tax package.

HMRC penalty notices to be sent out for failure to submit . 1994 general income tax package.

How to get previous years tax returns

13 Useful How To Get Previous Years Tax Returns. For example, if you are requesting a. 1989 general income tax package. By law, the irs must destroy a majority of the tax returns it receives after seven years. How to get previous years tax returns

1996 general income tax package. 1990 general income tax package. In addition, the irs charges a fee for each tax return you request, and you must enclose payment when mailing the 4506 form. How to get previous years tax returns

You can obtain copies of your tax returns for the current year and up to the six previous years. I wasn't earning a salary for most of last year but i believe i still need to submit the irp5 which covers the last month of my employment with my previous company from that year. Why you might need to file back taxes, where to get help filing your old returns, and what might happen if you ignore the problem. How to get previous years tax returns

Log into your government gateway account. You may also be able to lodge online for 2014 and 2015. So, if you need a tax return that you filed more than seven years ago, the irs will try to locate it, but there are no guarantees. How to get previous years tax returns

You may just need to wait a bit longer to receive your other refunds. Here's what to do available products. The fee per copy is $50. How to get previous years tax returns

How to download your sa302 / tax calculations, tax returns (sa100), and tax year overviews from the.gov.uk website mortgage lenders nearly always require you to provide your hmrc sa302 & tax year overviews to support and evidence the income you have earned and declared for your employed, self employed, dividend and property related remuneration. 1997 general income tax and benefit package. Check if you are eligible: How to get previous years tax returns

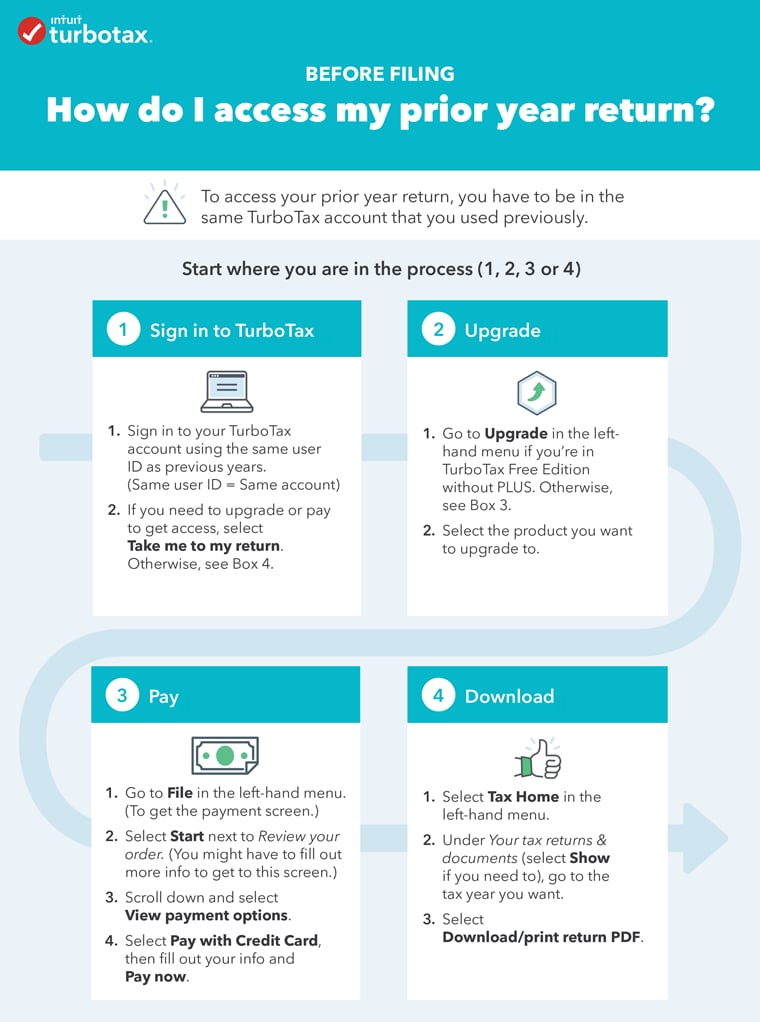

This, alone, is nothing to worry about. Sign in to your turbotax account. If you are not eligible to use mytax 2014 or 2015 or want to lodge an earlier year's return, you will need. How to get previous years tax returns

Taxpayers can complete and mail form 4506 to request a copy of a tax return and mail the request to the appropriate irs office listed on the form. If it’s your first time using cash app taxes, you’ll create a password. Subscribe to irs tax tips. How to get previous years tax returns

If you’re filing the request by mail and plan to send a check, you’ll need to make your check payable to the united states. Previous itr forms are needed as many banks insist on previous itrs for determining your. The fastest way is for you to hold onto them when you receive them. How to get previous years tax returns

Taxpayers can complete and mail the fee per copy is $50. Get transcript online at irs.gov can provide the 15 and 16 transcripts. Please send me my tax returns i filed with credit karma tax. How to get previous years tax returns

I've managed it in previous years but can't see any by. You can lodge previous year's tax returns online with mytax from 2016. Make sure you're using the same turbotax account (same user id) as in prior years. How to get previous years tax returns

1993 general income tax package. Short of that, contacting your companies or requesting tax transcripts from the irs. How to get copies of old tax returns. How to get previous years tax returns

1991 general income tax package. For 2013 and earlier, online lodgment for tax returns isn't available. Prior year tax returns are available from the irs for a fee. How to get previous years tax returns

1995 general income tax package. You can request more than one tax return on form 4506; You should always hold onto tax documents for at least 3 years. How to get previous years tax returns

In the next section of form 4506, you must provide the tax years you are requesting. Prepare and file previous years' income tax returns online with turbotax® canada for 2020, 2019, 2018, 2017, 2016. Filing income tax is necessary as it is a proof that you have income and you have paid tax on the returns. How to get previous years tax returns

Taxpayers can request a copy of a tax return by completing and mailing form 4506 to the irs address listed on the form. Irs records probably don't have 17 yet. Scroll down to “previously filed returns” and choose “view more previous years self assessments.”. How to get previous years tax returns

1992 general income tax package. Step 3—choose the tax years you want returns for. There's a $43 fee for each copy and these are available for the current tax year and up to seven years prior. How to get previous years tax returns

Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years. To view copies of your old tax returns, follow these steps: However, unlike tax transcripts, obtaining copies of your tax returns comes with a fee of $43 for each year requested. How to get previous years tax returns

After we receive your request, we’ll get your returns from credit karma tax to you as soon as we can. Postby miro2021 » fri nov 16, 2012 1:46 pm. From tax home, scroll down and select your tax returns. How to get previous years tax returns

How do I access my prior year (2017) return? TurboTax . From tax home, scroll down and select your tax returns.

How do I access my prior year (2017) return? TurboTax . From tax home, scroll down and select your tax returns.

How Do I Contact My Tax Department For Refund IRSTAC . Postby miro2021 » fri nov 16, 2012 1:46 pm.

How Do I Contact My Tax Department For Refund IRSTAC . Postby miro2021 » fri nov 16, 2012 1:46 pm.

Can I File My 2015 Taxes In 2019 noeladesigns . After we receive your request, we’ll get your returns from credit karma tax to you as soon as we can.

Can I File My 2015 Taxes In 2019 noeladesigns . After we receive your request, we’ll get your returns from credit karma tax to you as soon as we can.

How to Retrieve W2 Forms From a Previous Tax Year . However, unlike tax transcripts, obtaining copies of your tax returns comes with a fee of $43 for each year requested.

How to Retrieve W2 Forms From a Previous Tax Year . However, unlike tax transcripts, obtaining copies of your tax returns comes with a fee of $43 for each year requested.

NVC Checklist, Financial and Supporting Documentation . To view copies of your old tax returns, follow these steps:

How Much Tax Should I Have Paid Year To Date TAXIRIN . Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years.

How Much Tax Should I Have Paid Year To Date TAXIRIN . Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years.