5 Amazing How To Lower Your Interest Rate On Credit Card Work

10 Jackpot How To Lower Your Interest Rate On Credit Card - Webb space telescope reaches its destination Your lender will review your credit, so you’ll want to make sure there are no red flags that can prevent you from getting a lower interest rate.

How to Lower Your Credit Card Interest Rate? LendEDU . About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features

How to Lower Your Credit Card Interest Rate? LendEDU . About press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features

How to lower your interest rate on credit card

7 Exclusive How To Lower Your Interest Rate On Credit Card. Here’s what to look for on your credit report: If you’re concerned about the possibility of carrying a credit card balance during the coronavirus pandemic, you may be able to lower your interest rates by contacting your card issuers right now. Creditcards.com research released in march 2016 shows that while relatively few ask, more than 3 in 4 cardholders who ask for a lower interest rate get it. How to lower your interest rate on credit card

A credit card is a useful way to make purchases. Let’s assume you owe $6,000 in credit card debt at an interest rate of 18%, and make only the minimum payment of $180 each month (3% of $6,000), you will pay $2,380.33 in interest charges over the life of the debt. If the interest rate on your card is higher How to lower your interest rate on credit card

I reached out to five major credit card companies to see if. No matter what interest rate your current cards are charging, the chances are pretty good that “zero” is a fair sight better. You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a reduction. How to lower your interest rate on credit card

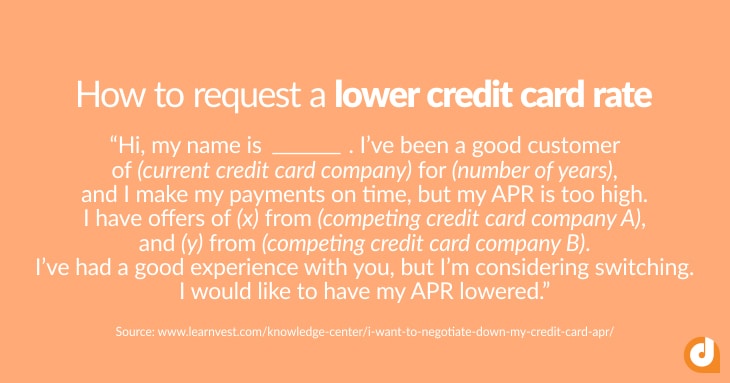

How to ask your credit card provider for a lower interest rate once you feel ready to ask for a lower rate, the negotiation can begin. You have the best chances if your credit score has improved since account opening, and you pay your bills in full and on time. Call and make your request. How to lower your interest rate on credit card

Sign up for an introductory 0% apr credit card offer. The first step is to make sure you know your own credit history and credit score, says gail cunningham, spokeswoman. But paying interest on those purchases could make everything you buy a little more expensive. How to lower your interest rate on credit card

With average credit card interest rates currently ranging from about 13% to 23%, interest charges can add up fast. You can pay no or little interest if you pay off the balance transferred within the promotional. Make sure to review all of your credit reports before you pick up the phone. How to lower your interest rate on credit card

Most balance transfer credit cards offer 0% or slightly higher interest rate offer for a certain period of time. Now you’re ready to get your credit card and call the customer service number listed on the back. You can haggle for a better apr, and these tips will help you do so successfully. How to lower your interest rate on credit card

One of the best ways to get a lower interest rate on your credit card for a limited time is to apply for a balance transfer credit card. That means each time the federal reserve shifts rates, your credit card is probably going to be impacted. Who carry credit card debt from month to month, then you may be looking for ways to cut that bill. How to lower your interest rate on credit card

Typically, a creditor will agree to accept 40% to 50% of the debt you owe , although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. Take an inventory of your financial health and credit standing. The average credit card annual percentage rate is now between about 15% and 23%, according to u.s. How to lower your interest rate on credit card

However, lowering your interest rate is still a beneficial thing to do. There’s plenty that factors into interest charges, but a big part is your annual percentage rate (apr)—and how high it is. Your best path forward will depend on your monthly income and budget, your credit score, your total amount of debt and your lender’s credit card policies. How to lower your interest rate on credit card

Negotiating a lower interest rate credit card interest rates are tied to prime rates. Getting a lower interest rate could be as easy as calling and asking. Call your credit card companies to negotiate a better rate. How to lower your interest rate on credit card

But if you opened your account at a time when your credit wasn't that great. Depending on your credit card issuer, if you ask for a lower interest rate, a customer service specialist can submit a request on your behalf. How to lower your credit card interest rate. How to lower your interest rate on credit card

When you reach a representative, politely explain the reason for your call. Keep in mind that not every credit card issuer or bank accepts these requests and there Here's how to prepare and what to say to get a lower interest rate on your credit card. How to lower your interest rate on credit card

It can be surprisingly easy to lower your interest rate. A lower apr is a request that many card issuers will grant to customers. Whereas if you negotiate a 3% decrease in your apr to 15%, you will pay $1,988.18 in interest charges over the life of the debt. How to lower your interest rate on credit card

What percentage will credit card companies settle for? Your income also may be a factor in determining your interest rate and, especially, your borrowing limit. Who knows when or why you may have an emergency requiring you to utilize your credit card and carry a balance for longer than a one month period. How to lower your interest rate on credit card

How to lower your credit card interest rate and save money . Who knows when or why you may have an emergency requiring you to utilize your credit card and carry a balance for longer than a one month period.

How to lower your credit card interest rate and save money . Who knows when or why you may have an emergency requiring you to utilize your credit card and carry a balance for longer than a one month period.

How to Lower Your Credit Card Interest Rate Rate Rush . Your income also may be a factor in determining your interest rate and, especially, your borrowing limit.

How to Lower Your Credit Card Interest Rate Rate Rush . Your income also may be a factor in determining your interest rate and, especially, your borrowing limit.

Here's How to Get a Lower Interest Rate On Your Credit . What percentage will credit card companies settle for?

Here's How to Get a Lower Interest Rate On Your Credit . What percentage will credit card companies settle for?

Credit card interest rates are higher than ever, but 8 . Whereas if you negotiate a 3% decrease in your apr to 15%, you will pay $1,988.18 in interest charges over the life of the debt.

Credit card interest rates are higher than ever, but 8 . Whereas if you negotiate a 3% decrease in your apr to 15%, you will pay $1,988.18 in interest charges over the life of the debt.

5 Tips on How to Negotiate Lower Credit card and Interest . A lower apr is a request that many card issuers will grant to customers.

5 Tips on How to Negotiate Lower Credit card and Interest . A lower apr is a request that many card issuers will grant to customers.

How to Lower Your Credit Card Interest Rate The Best Guide . It can be surprisingly easy to lower your interest rate.

How to Lower Your Credit Card Interest Rate The Best Guide . It can be surprisingly easy to lower your interest rate.